The Cool Wall

[Updated]

To pay tribute to one of my all time favorite TV shows – Top Gear (British version, not the boring American one) – I’ve decided to create a business-driven “Cool Wall.” For those who don’t know, Top Gear is a motoring TV show that stars hosts Jeremy Clarkson, Richard Hammond, and James May, drawing a crowd of approximately 350 million viewers in 170 countries worldwide each week.

One segment of the show includes The Cool Wall, in which cars are categorized as “Sub Zero,” “Cool,” “Un-Cool,” and “Seriously Un-Cool.”

Given the focus of this blog, I thought why not create my own ‘Cool Wall’ and rank a variety of businesses, investments, corporate figures and even a few products and services!

SUB ZERO

People

Danny Williams, Former Premier of Newfoundland and Labrador

Now, I understand that I’ve stated this blog is going to deal with “strictly business,” however, I have to include Canadian Politician Danny Williams on The Cool Wall. And for good reason: He’s a genius when it comes to business. Not only is Williams a tenacious politician but he knows how to put up a fight in the business world. Prior to getting into politics, Williams (still in university) led a consortium of business people that were granted Newfoundland’s first cable television licenses. After numerous acquisitions, Danny was able to turn Cable Atlantic into one of Atlantic Canada’s largest communications companies. As the principal owner, he eventually sold it, after negotiating numerous low offers, to none other than Ted Rogers’ Rogers Cable Inc. for $282 million. No wonder he has been nicknamed Danny “Millions.”

Now, I understand that I’ve stated this blog is going to deal with “strictly business,” however, I have to include Canadian Politician Danny Williams on The Cool Wall. And for good reason: He’s a genius when it comes to business. Not only is Williams a tenacious politician but he knows how to put up a fight in the business world. Prior to getting into politics, Williams (still in university) led a consortium of business people that were granted Newfoundland’s first cable television licenses. After numerous acquisitions, Danny was able to turn Cable Atlantic into one of Atlantic Canada’s largest communications companies. As the principal owner, he eventually sold it, after negotiating numerous low offers, to none other than Ted Rogers’ Rogers Cable Inc. for $282 million. No wonder he has been nicknamed Danny “Millions.”

Companies

Kiva.org

I found out about Kiva several years ago after it was featured on a TV show and, I must say, it is an ingenious solution to solving the world’s problems. For those who like to know where their contributions go, Kiva is an excellent organization that lets you sleep easy knowing that your donations actually got to a person who needs it. Essentially, Kiva.org acts as a facilitator in linking much needed funds from around the world to some of the poorest and most underprivileged individuals. According to the Kiva website…

“Kiva lets you connect with and loan money to unique entrepreneurs in the developing world. By choosing a loan on Kiva, you can “sponsor a business” and help the world’s working poor make great strides towards economic independence. Throughout the course of the loan (usually 6-12 months), you can receive email journal updates from the entrepreneur you’ve sponsored. As loans are repaid, you get your loan money back.”

Kiva.org is considered, in my books, Sub Zero Cool as it has the power to solve a number of world problems all at once: first poverty, then malnutrition, then poor health, then illiteracy etc. I know capitalism has its faults, but Kiva truly defies the “money-hungry, greed-driven, and corrupt-stained” image capitalism conjures up.

Investment

Short-Selling

According to Investopedia, “Short-selling is the selling of a security that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short-sellers assume that they will be able to buy the stock at a lower amount than the price at which they sold short.” In essence, selling-short is the opposite of going long and investors make money if the stock decks out. With today’s volatile markets, short-selling is definitely cool. (Novice investors beware)

Products

Heineken Draught Keg

The Heineken Draught Keg is simply an amazing product that is seriously Cool. In essence, it is like taking your favorite pub and stuffing it into your fridge. The mini-keg holds 5-liters of Heineken beer that lasts up to 30 days after tapping (and it still tastes fresh when the 30th day arrives!). Additionally, once the keg is empty, you’re left with a great decorative item for your home. Great for parties. Great to have around the house. And great enough to be ranked Sub Zero Cool.

Rubik’s Cube

With over 350 million units sold around the world, the world’s best-selling toy deserves to be on The Cool Wall. Period.

COOL

People

Jerome Kerviel, Société Générale S.A.

No cool wall would be complete without French-native Jerome Kerviel. For those who don’t know, Jerome was a futures trader who cost France’s No. 2 bank – Société Générale – 4.9 billion euros (or about $7.15 billion US). Employed by the bank since 2000, Kerviel worked his way up from a supporting role in an office that monitors trades to a job on the more attractive futures desk where he invested the bank’s money by hedging on European equity market indexes, placing bets on how the markets would perform. Unfortunately his trades didn’t turn out as he expected and he had to cover his trails by manipulating internal controls at the bank or risk losing his job. In the end, his losses were uncovered; he was fired; and eventually charged with a criminal offence. But the interesting thing about the whole ordeal is that he doesn’t appear to have benefited from any of it!

No cool wall would be complete without French-native Jerome Kerviel. For those who don’t know, Jerome was a futures trader who cost France’s No. 2 bank – Société Générale – 4.9 billion euros (or about $7.15 billion US). Employed by the bank since 2000, Kerviel worked his way up from a supporting role in an office that monitors trades to a job on the more attractive futures desk where he invested the bank’s money by hedging on European equity market indexes, placing bets on how the markets would perform. Unfortunately his trades didn’t turn out as he expected and he had to cover his trails by manipulating internal controls at the bank or risk losing his job. In the end, his losses were uncovered; he was fired; and eventually charged with a criminal offence. But the interesting thing about the whole ordeal is that he doesn’t appear to have benefited from any of it!

Now of course the loss was a major blow to the bank, but it’s a bit refreshing hearing about someone who worked at bank and didn’t steal millions of dollars for themselves, but instead, simply, screwed up!

Jim Pattison, Chairman & CEO of The Jim Pattison Group

Jim Pattison is classified as Cool for simply being a hardworking entrepreneur with the never ending drive to succeed. He built his businesses in Western Canada from the ground up and, today, is considered the 3rd wealthiest Canadian with a net worth of over $5.8 billion.

Thane Heins, Founder of Potential Difference Inc.

Investors, get your money ready. Apparently, Thane Heins of Ottawa has invented a perpetual motion machine that may in fact work. Although perpetual motion ultimately defies the laws of physics, his invention appears to be legit. So far he’s traveled to various universities in Canada and the US meeting with top academics to showcase the invention and has formed a company – Potential Difference Inc. – to develop and market it. The invention, at its very least, could moderately improve the efficiency of induction motors, used in everything from electric cars to ceiling fans. At best, it means a way of tapping the powers of electromagnetic fields to produce more work out of less effort, seemingly creating electricity from nothing.

Warren Buffett, Chairman & CEO Berkshire Hathaway

I’m quite sure everyone reading this is aware of the “Oracle of Omaha.” And I’m quite sure everyone reading this would agree Warren Buffett is Cool.

I’m quite sure everyone reading this is aware of the “Oracle of Omaha.” And I’m quite sure everyone reading this would agree Warren Buffett is Cool.

Warren Buffett is hands down the greatest investor the world has ever seen. Through patient and truly dedicated investing, Buffett has amassed a fortune of well over $50 billion. But it’s not his wealth that makes Warren Buffett, Warren Buffett. Rather, it’s his character. He’s very down-to-earth, modest, humble, soft-spoken, and frugal (although I’d say he’s more reasonable than thrifty – his annual salary is only $100,000 a year and he still lives in the same house he bought in Omaha in 1958 for $31,500. His favorite drink isn’t Cristal, its Cherry Coke. He doesn’t drive a Bentley, he drives a Cadillac.).

Buffett’s character is only part of why he is on The Cool Wall. There is after all, his generous donations to numerous charities and his pledge to give away 99-percent of his wealth when he passes away.

Companies

Wind Mobile

For years, Canadians were getting shafted when it came to their wireless services – we paid the most for pretty standard telecommunications technology. Many tourists to Canada were surprised at how subpar the whole industry was compared to their home countries (but most Canadians couldn’t do much about it when only 3 companies controlled everything). Eventually the Canadian market caught the eye of other global telecoms and Wind Mobile was established in 2009.

For years, Canadians were getting shafted when it came to their wireless services – we paid the most for pretty standard telecommunications technology. Many tourists to Canada were surprised at how subpar the whole industry was compared to their home countries (but most Canadians couldn’t do much about it when only 3 companies controlled everything). Eventually the Canadian market caught the eye of other global telecoms and Wind Mobile was established in 2009.

Wind Mobile is considered Cool for shaking up the market and getting rid of industry-standard B.S. Out with long-term contracts; out with ridiculous charges; out with awful, overpriced plans. For that reason, they’re on The Cool Wall.

Facebook Inc.

One word: Remarkable.

Facebook was included on the original Cool Wall when this blog was started for simply being a great website. At the time, it was the fastest growing social networking website in the world. Today, it is one of the largest companies in the world with a market cap of $65 billion. And for that reason, it’s Cool.

Facebook was launched in 2004 by a Harvard student as way to ‘connect’ people on campus. Users could create a profile, add friends to their contact lists, and talk to one another while joining various interest groups. It was essentially the modern way to ‘keep-in-touch’. Within two years the website expanded to include practically every university and college in the world (I joined in 06 when YorkU was added!). Eventually, high schools were added to the site and not long after anyone with an e-mail could sign up (including grandma and grandpa!).

After several appearance changes, ads were placed throughout the website and the investment community began to take notice as the money started pouring in. A bunch of venture capitalists and even some major tech giants like Microsoft began throwing capital at the website-turned-company to ‘help it grow’. And grow it did; to over 500 million active users worldwide, which resulted in a successful movie if you can believe it. Pressure from investors eventually made the company go public (in a somewhat shoddy IPO) in 2012.

Steam Whistle Brewing

One of Canada’s most prolific microbreweries, Steam Whistle is certainly Cool. The company was founded in 1998 by three friends who were previously fired from Upper Canada Brewing Company after it was bought out by Sleeman’s. The original name the founders intended to use for their new company was “Three Fired Guys Brewing Company,” but instead they decided to go with Steam Whistle, signifying the end of each working day (As a joke, “3FG” is engraved near the bottom of every bottle of Steam Whistle for “3 Fired Guys”). After moving into one of Toronto’s historic Roundhouses (right next to the CN Tower and Rogers Centre), the company’s premium pilsner – packaged in long green glass bottles with non-twist caps – has enjoyed great success. However, the beer is only deserving of part of the company’s success; the rest comes from great marketing practices that have made Steam Whistle a dominant competitor in Ontario.

One of Canada’s most prolific microbreweries, Steam Whistle is certainly Cool. The company was founded in 1998 by three friends who were previously fired from Upper Canada Brewing Company after it was bought out by Sleeman’s. The original name the founders intended to use for their new company was “Three Fired Guys Brewing Company,” but instead they decided to go with Steam Whistle, signifying the end of each working day (As a joke, “3FG” is engraved near the bottom of every bottle of Steam Whistle for “3 Fired Guys”). After moving into one of Toronto’s historic Roundhouses (right next to the CN Tower and Rogers Centre), the company’s premium pilsner – packaged in long green glass bottles with non-twist caps – has enjoyed great success. However, the beer is only deserving of part of the company’s success; the rest comes from great marketing practices that have made Steam Whistle a dominant competitor in Ontario.

Investment

ING Direct GICs

For Canadians seeking to park their money in a safe investment, nothing beats an ING Direct GIC. When interest rates were much higher several years ago, I decided to put some money in a GIC. While GICs are pretty much the same throughout Canada, I’ve found that the ones offered by ING Direct are some of the best. Aside from being safe and secure, there were no fees, service charges or even an early withdrawal penalty! And for that reason, ING Direct GICs are Cool.

Products

Energy Drinks, Red Bull, Monster, AMP etc.

Energy Drinks, Red Bull, Monster, AMP etc.

Energy drinks, like Facebook, have become extremely popular over the last few years. These soft drinks, which are filled with a mix of vitamins, taurine, caffeine, and herbal ingredients, are designed to provide consumers with energy for ‘increased mental alertness and physical performance.’ Although being denounced by some physicians, and countries (France & Denmark), energy drinks such as Red Bull, AMP, and Monster have become vital to university and college students who primarily seek the potency of these heaven-sent products. Goldman Sachs estimated that the energy drink market was worth over $10 billion in 2010.

UN-COOL

People

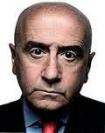

Robert Nardelli, former CEO of The Home Depot & Chrysler

Robert Nardelli, former CEO of The Home Depot & Chrysler

Robert Nardelli completely screwed up The Home Depot by cutting employee incentives and taking other streamline policies in an effort to boost profits. In turn, customer satisfaction plummeted under his reign and the once friendly neighborhood hardware store became a cold, cold place. He was ousted in 2007, leaving with a fat severance package worth more than $200 million. Then he took the lead role of Chrysler…which eventually filed for Chapter 11 bankruptcy. It’s no wonder CNBC named Nardelli as one of the “Worst American CEOs of All Time.”

Companies

Nortel Networks Corporation

Investors in technology stocks in the 1990s saw an extraordinary run-up in the value of their holdings. A tech stock high flyer was Nortel Networks, a Canadian multinational telecommunications equipment manufacturer. At its peak of $123.10 in July 2000, Nortel accounted for approximately 40 percent of the TSX Composite Index. However, in the early years of the new millennium Nortel Networks came under scrutiny for accounting problems that led to over-stated profits. The Nortel board of directors ended up firing the CEO, CFO, and controller and initiated an investigation to assess who was responsible for severe accounting manipulations. The stock price of Nortel plummeted on the news of the frauds: By the fall of 2002, Nortel’s stock was worth less than $1. But the fiasco was like a rock being dropped in a tranquil pond; the negative effects of Nortel spilled over to other companies as investors lost faith in many firms’ financial statements. Un-Cool no matter how you slice it.

Investors in technology stocks in the 1990s saw an extraordinary run-up in the value of their holdings. A tech stock high flyer was Nortel Networks, a Canadian multinational telecommunications equipment manufacturer. At its peak of $123.10 in July 2000, Nortel accounted for approximately 40 percent of the TSX Composite Index. However, in the early years of the new millennium Nortel Networks came under scrutiny for accounting problems that led to over-stated profits. The Nortel board of directors ended up firing the CEO, CFO, and controller and initiated an investigation to assess who was responsible for severe accounting manipulations. The stock price of Nortel plummeted on the news of the frauds: By the fall of 2002, Nortel’s stock was worth less than $1. But the fiasco was like a rock being dropped in a tranquil pond; the negative effects of Nortel spilled over to other companies as investors lost faith in many firms’ financial statements. Un-Cool no matter how you slice it.

Investment

Insider Trading

Un-Cool, unless those involved are willing to share some information (Refer to Contact page…I kid).

Hedge Funds

Investopedia defines hedge funds as, “An aggressively managed portfolio of investments that uses advanced investment strategies such as leverage, long, short and derivative positions in both domestic and international markets with the goal of generating high returns (either in an absolute sense or over a specified market benchmark). Legally, hedge funds are most often set up as private investment partnerships that are open to a limited number of investors and require a very large initial minimum investment. Investments in hedge funds are illiquid as they often require investors keep their money in the fund for at least one year.”

All that can be really said about Hedge Funds is that they are far too sketchy.

Products

Multi-Blade Razors, Gillette, Schick etc.

Multi-Blade Razors, Gillette, Schick etc.

Great products, but the way they are sold is Un-Cool. Freebie marketing, also known as the razor and blades business model, is a business model wherein one item is sold at a low price (i.e. the razor) in order to increase sales of a complementary product (i.e. the blades). Most of the modern 3-5 blade safety razors sold by Gillette and Schick only cost around $10, but the replacement blades can run up to $40 or more. Well technically consumers save by buying blades in bulk instead of individual razors, the model becomes ludicrous when you consider how much it actually costs to manufacture the blades: less than $0.10. At going retail prices, that becomes a mark-up of more than 4,750%, which is total BS.

SERIOUSLY UN-COOL

People

Jim Cramer, MAD Money

Jim Cramer, MAD Money

Jim Cramer is the host of popular CNBC business show MAD Money, where he essentially provides advice and stock picks to viewers (who can actually call in with questions regarding their portfolios) in an “entertaining fashion.” I don’t think anyone will doubt that this former hedge fund manager has made a killing in the market, but he’s still Seriously Un-Cool for being a total nut-bar (don’t believe? Watch the show). Additionally, there is too much controversy over almost every pick this guy makes: Either he successfully manipulates the market, or he fails miserably. For instance, Cramer recommended dot com companies as being the best thing to own in 2000, just before the bubble burst. Oh, and don’t forget his great recommendations for real estate and banking just before the credit crunch… Investors, don’t be fooled; Cramer is no Buffett.

Kevin Trudeau, “Cures” publications

Kevin Trudeau, “Cures” publications

Con artist anyone? You’ve probably seen this self-proclaimed medical/financial expert on numerous late-night TV infomercials promoting his books that attack certain institutions, such as pharmaceutical companies. The fact of the matter is, this guy has no formal training in what he promotes, uses false endorsements, and has had one too many run-ins with the law. Don’t be fooled by glamorous marketing campaigns. Read between the lines. And next time you see one of his infomercials, just remember he’s classified as Seriously Un-Cool.

Richard “Dick” Grasso, Former CEO of the NYSE

Richard “Dick” Grasso, Former CEO of the NYSE

When the SEC began to poke around the NYSE, it forced the exchange to disclose information pertaining to salaries and bonuses. On August 27, 2003, the exchanged admitted that Grasso had received payments of more than $12 million in 2002 and 2003 in salary and incentives, and had been awarded a retirement package that was paid in cash in 2003 (5 years before retirement, allegedly to facilitate estate planning) that totaled $139.4 million. Don’t get me wrong, multimillion-dollar pay packages are a common thing on Wall Street, but those packages are generally tied to performance. How much did the NYSE reportedly make in 2002-2003? Only $28 million. Seriously Un-Cool.

Companies

Metro, Daily Newspapers

Metro, Daily Newspapers

By far, the worst news publication in Canada. I’m not attacking the media or anything of that nature, but Metro newspapers are absolute garbage. For those who don’t know, Metro publishes very short daily “papers” in most of the big Canadian cities. The catch? Metro is free (earns its revenues from advertisements). Now everyone would assume something that is free is generally good, but not in this case. The quality of the writing is terrible. The columnists are terrible. And the paper itself, which is filled with never ending advertisements, does nothing but contribute to pollution in all of the cities Metro is printed in. Worst of all is that the paper drives out quality newspaper publications, resulting in unwarranted job losses.

Toronto Transit Commission (TTC)

Toronto Transit Commission (TTC)

Since 1954 the TTC has been providing the city of Toronto with lousy public transportation. Now I understand that public transport is a necessity in every major city and is a great way to curb emissions of CO2 per person. But who are we kidding? The service, has, and will continue to be, awful. Buses never run according to schedule. Street cars are mind-numbingly slow and lack proper heating/cooling/ventilation. Trains are also slow, unreliable, and have a tendency to make you late when you have to get somewhere important! And yet nothing drastic is done to improve services! Instead, the big wigs running everything simply brush off rider complaints while threatening to hike fares – Seriously Un-Cool!

Investment

CDOs

CDO stands for Collateralized Debt Obligation. According to Investopedia, a CDO is “an investment-grade security backed by a pool of bonds, loans, and other assets.” CDOs are the primary security to blame for the “credit-crunch/banking crisis/subsequent recession.”

Ponzi Schemes

The cardinal rule of investing: “If it sounds too good to be true, it probably is.” Despite the age old adage, investors throughout the world continually get duped by slick con men. Instead of investing on their own, they decide to entrust their money with snakes in suits for the chance to make ‘higher than average returns.’ Such naivety and greed is what enabled financier Bernard Madoff to orchestrate the largest ponzi scheme in history resulting in losses of $65 billion.

Facebook Inc. IPO

While Facebook and its meteoric rise is undoubtedly Cool, the company’s recent IPO was anything but. On May18, 2012, Facebook officially went public on the Nasdaq in what was the most highly anticipated IPO of the year (perhaps in the past decade as well), which resulted in a company with a market capitalization of over $104 billion at one point. Unfortunately for many investors, the IPO was botched, perhaps intentionally.

While Facebook and its meteoric rise is undoubtedly Cool, the company’s recent IPO was anything but. On May18, 2012, Facebook officially went public on the Nasdaq in what was the most highly anticipated IPO of the year (perhaps in the past decade as well), which resulted in a company with a market capitalization of over $104 billion at one point. Unfortunately for many investors, the IPO was botched, perhaps intentionally.

Facebook was set to debut at 11:00 am, but trading was delayed due to technical problems with the exchange; even after shares opened, numerous technical glitches throughout the day prevented orders form successfully going through, costing investors hundreds of millions of dollars. Controversy grew in the subsequent days after it was revealed that just prior to the IPO, some Facebook executives had alerted industry insiders of future earnings information. At the same time, a number of underwriters on the deal had cut their earnings forecasts for the company – some being accused of disclosing the information to preferred clients first and not the general public. Was there collusion between market makers and the exchange operator? No one knows for certain, but numerous lawsuits have been filed to find out.

In the end, Facebook executives, venture capitalists, and private investors made a fortune dumping their shares that day while everyone else got the short-end of the stick in what The Wall Street Journal called a “complete fiasco.”

Products

Tablet Computers, iPad, PlayBook, etc.

By far, one of the worst computer innovations of all time! While tablets have been around since the 1990s, they only became popular gadgets for the masses after Apple launched the iPad in 2010 as an extension of its smart phone line of products. Soon after, every major tech company began releasing their own version of these ridiculous touch-screen toys. Now it seems like everyone has one or desperately wants one, which is even more ridiculous.

the 1990s, they only became popular gadgets for the masses after Apple launched the iPad in 2010 as an extension of its smart phone line of products. Soon after, every major tech company began releasing their own version of these ridiculous touch-screen toys. Now it seems like everyone has one or desperately wants one, which is even more ridiculous.

When you disregard all the marketing hype and compare the latest tablet with your average, run-of-the-mill laptop, you’ll find yourself overpaying for nothing. They’re not as fast as laptops, they’re not as user-friendly, they’re not as ergonomic, they’re not as durable and they’re not as productive for businesses (Yes, they are lighter, which apparently means they’re more ‘mobile,’ but how ‘connected’ does one person really need to be when you consider you’re attached to a computer at home and at work and when your cell/smart phone is turned on in between?) Yet despite all these faults, consumers are still willing to shell out big bucks for them…which boggles my mind and as a result is Seriously Un-Cool.

[…] The Cool Wall […]

By: Administrative Notice: ‘The Cool Wall’ back up « The Young Raging Bull on July 19, 2012

at 5:23 am